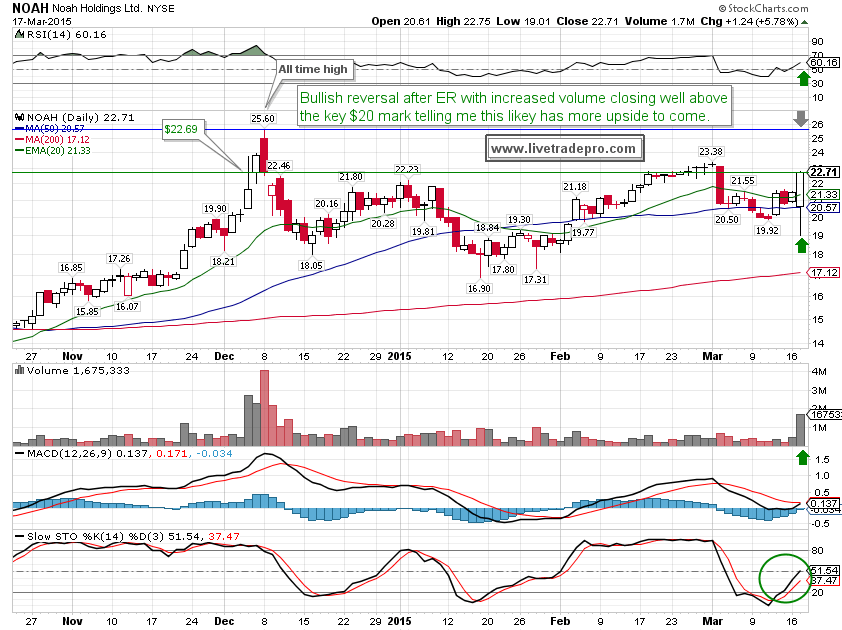

NOAH

Double click / tap to enlarge.

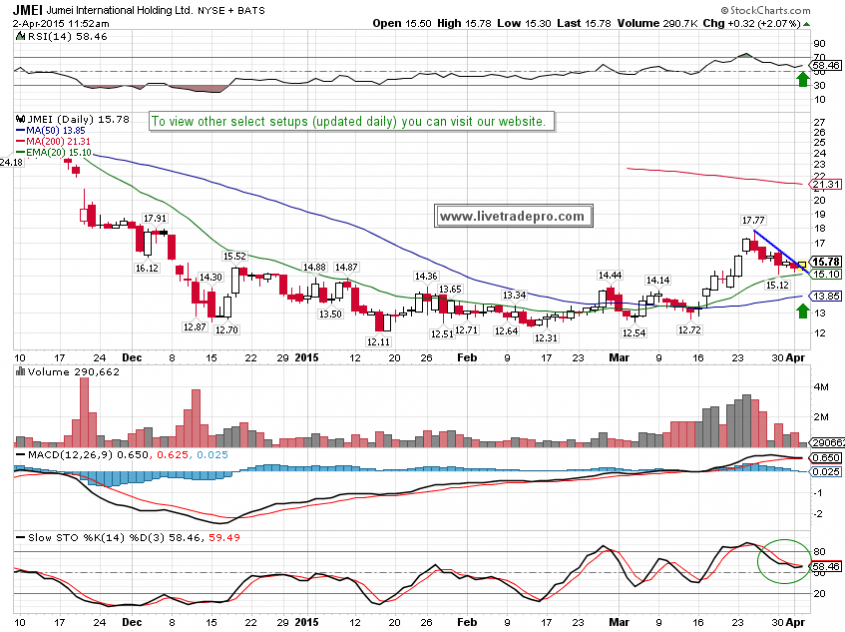

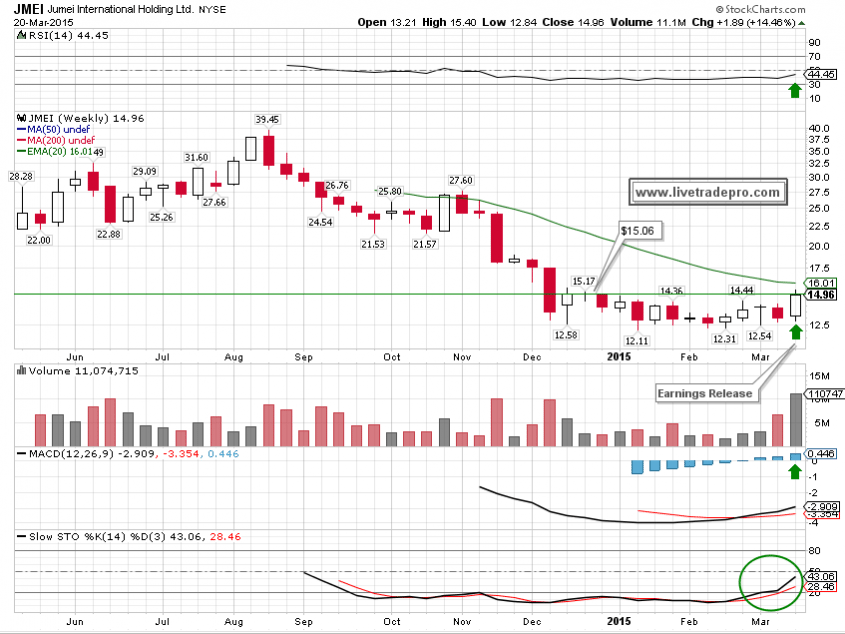

JMEI

Double click / tap to enlarge.

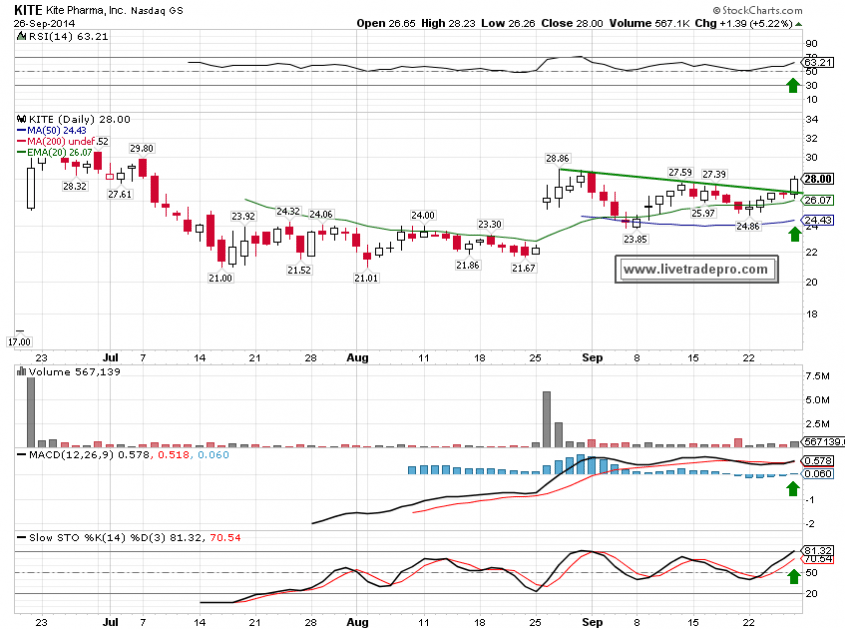

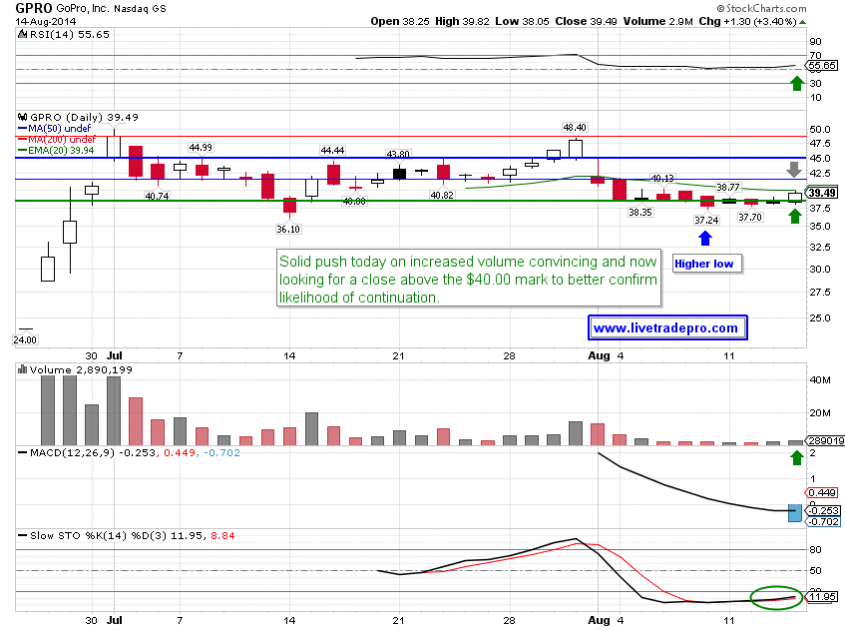

RMTI

The Set Up

Though there are typically several factors that I take into account when looking for the right set up, there are however two key major, key components that played an important part in the decision making process here… The $5.00 and $10.00 marks (significant levels in any stock) and consistency in increased volume (significant buy interest) even well above these key points.

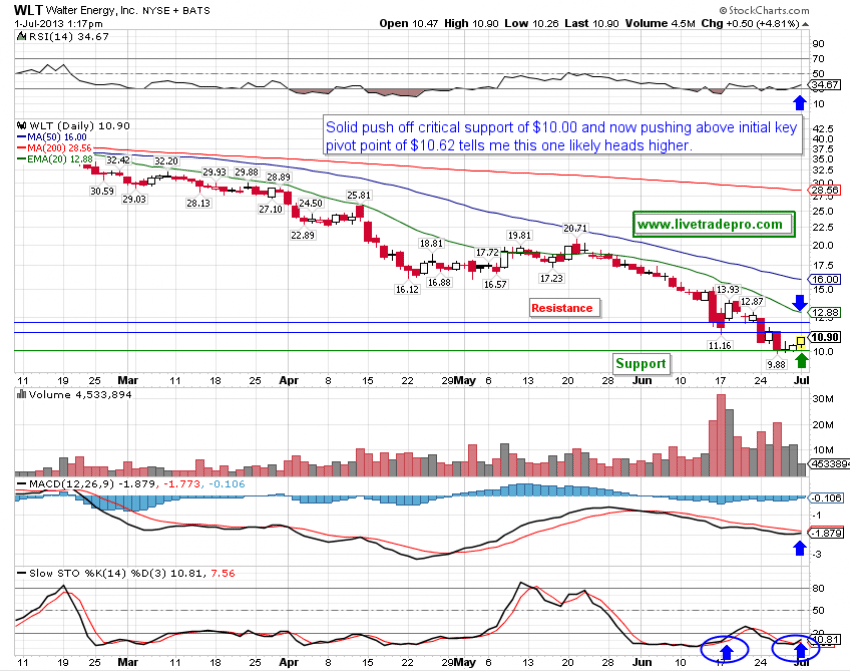

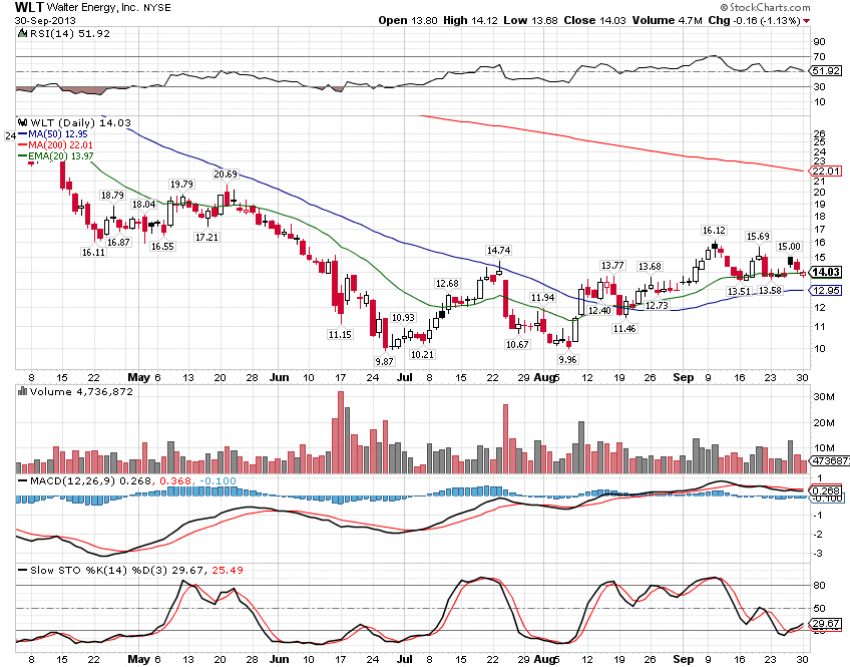

WLT

The Set Up

Not exactly considered a sweet heart of a stock at the time, however after falling from a 52 week high of $41.32 and down well from the highs of over $140.00 in the year of 2011, I thought it worth a more serious look after going under the critical $10.00 mark. (near 5 year lows) The technicals not so long after started to indicate that was indeed the mark. A lower downside risk play here, with signficant upside potential but this one was not for the faint of heart and certainly not one to be chasing.

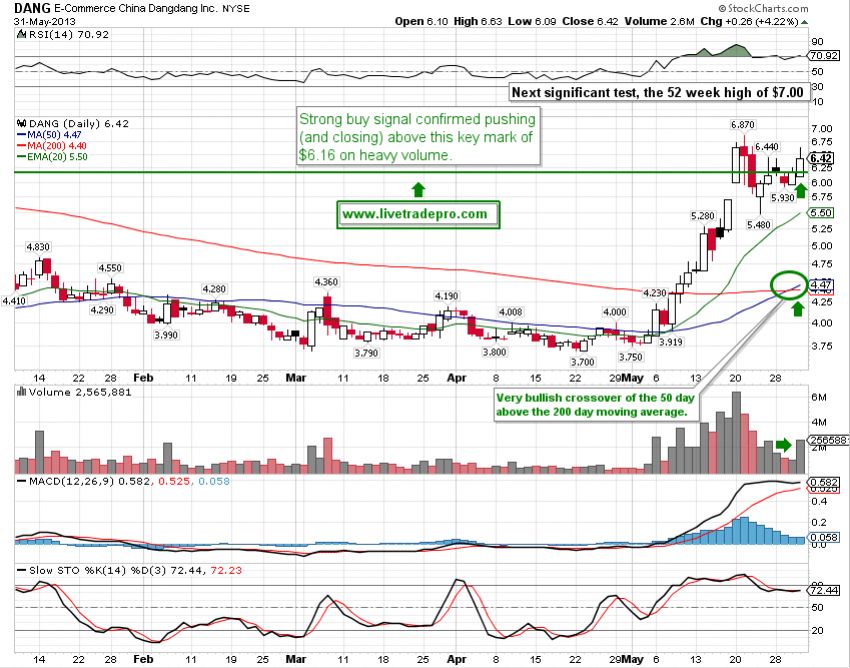

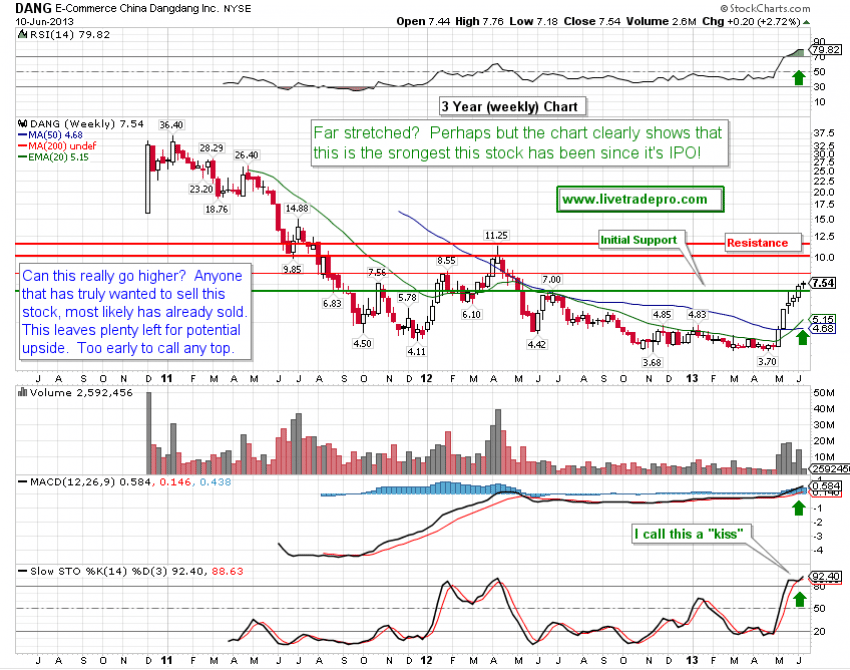

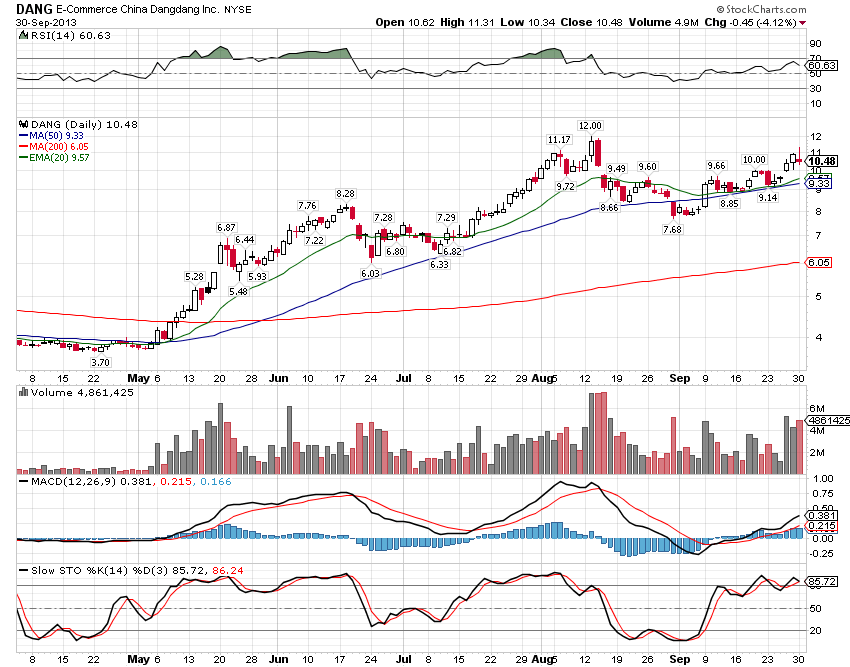

DANG

The Set Up

Loved this set up the moment I laid eyes on it. Everything about it said BUY. What’s not to love? A stock breaking out from a 6 month long base, pushing well above the $5.00 mark, on increased volume; along with the 50 day moving average crossing nicely above the 200 day moving average; along with MACD, Slow Stochastic and RSI confirming. Now after filling the gap and once again pushing well above the five dollar mark, I’m thinking this stock may still have some more upside potential here. We’ll see.

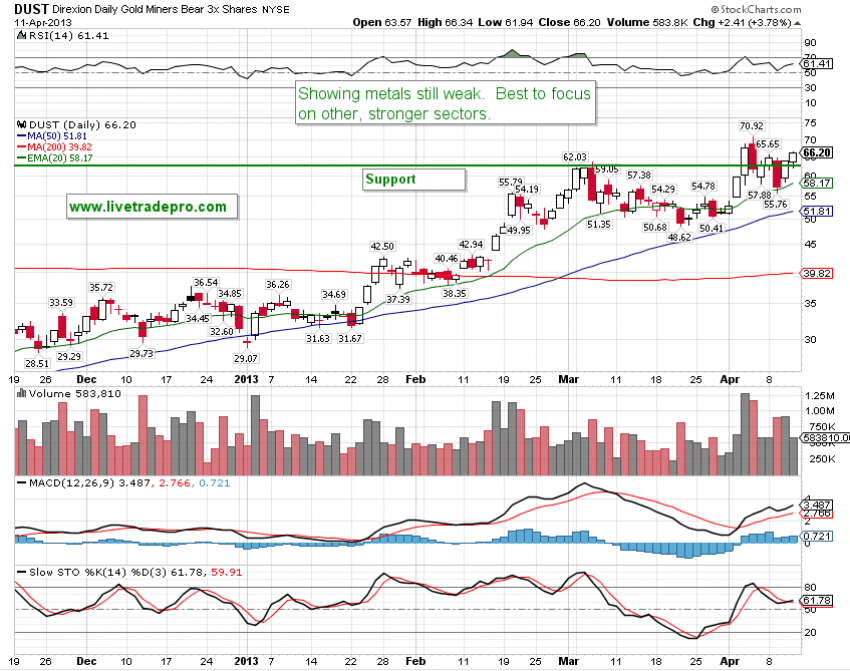

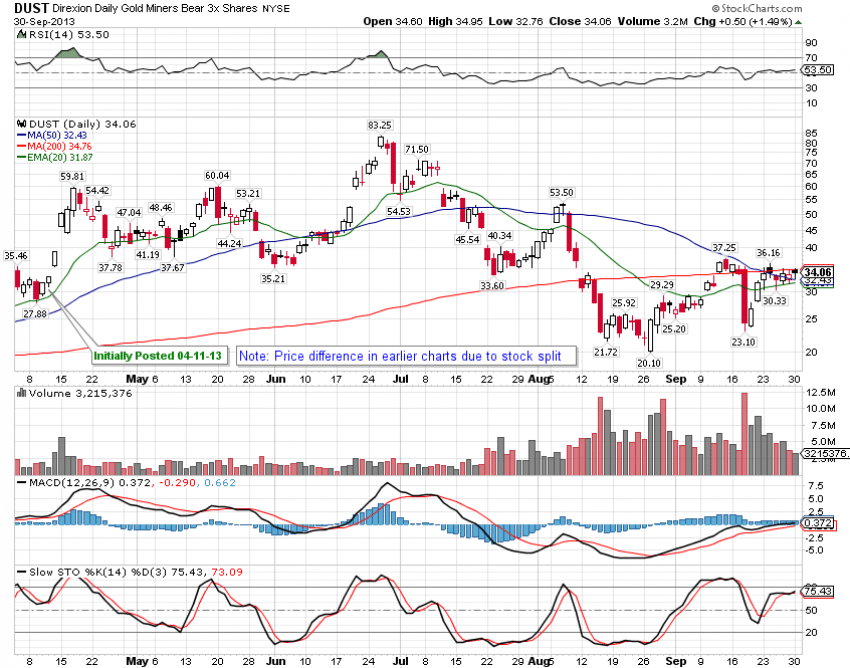

DUST

The Set Up

First found out about this stock after reading a commentary from a trader shorting it. (I hadn’t been paying much attention to gold stocks prior to this.) One look however told me that was totally the wrong thing to be doing here and that gold stocks were most likely to take a tumble. It was time to go long. This is what I call a no brainer and it certainly confirmed quickly to be the case, with excellent follow through. One key I’m ALWAYS looking for after establishing a buy point is to seek “confirmation” It’s critical and without it, I would suggest that you may want to seriously reconsider your position. Since this time gold stock (long and/or short) have provided many good trade opportunities (however volatile) and expect they likely will for some time.

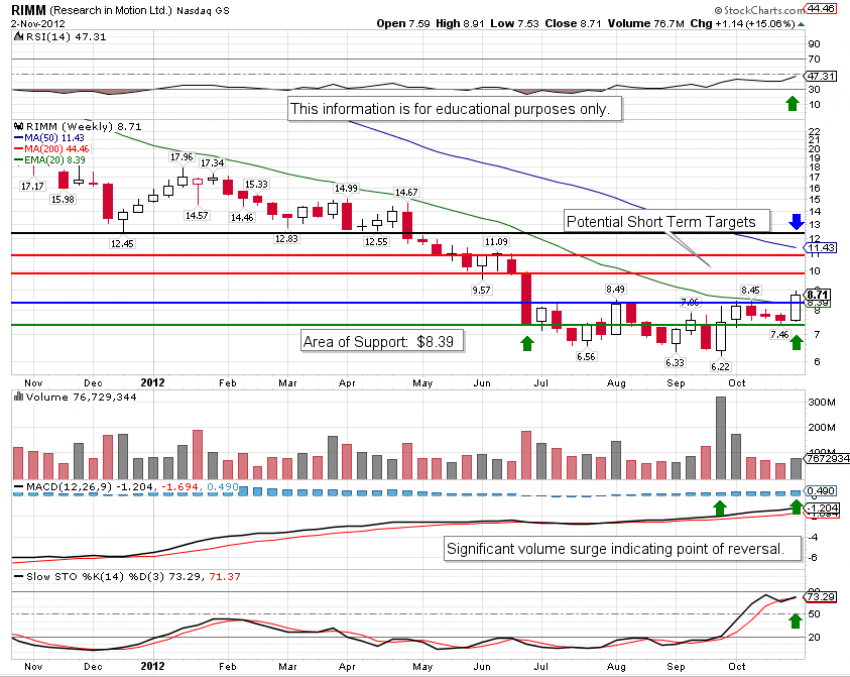

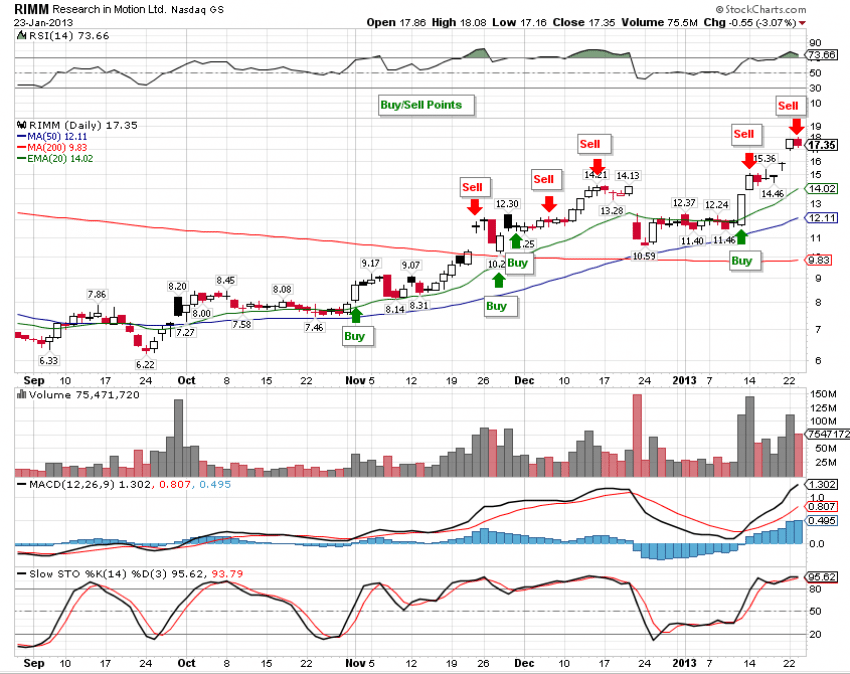

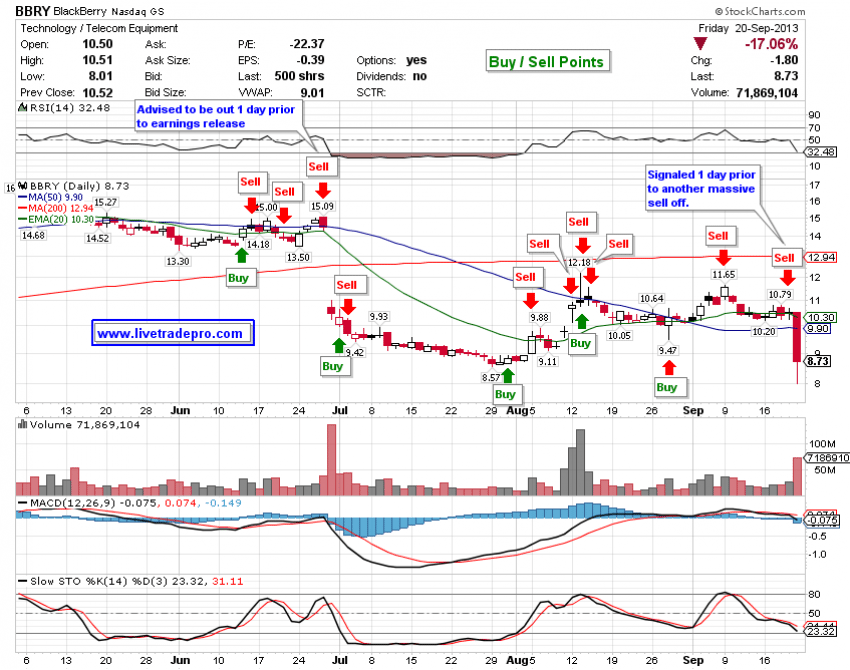

BBRY (RIMM)

The Set Up

This strong push above the 20 day moving average along with the clear evidence (confirmed by the huge surge in volume, then closing well above that close 5 weeks later) indicated the likelihood that this stock was now poised to make a considerable move upward. This stock not exactly in favor now, however that’s exactly what it was when first alerted in early November, in 2012 also. Am I trying to indicate that this stock will have a repeat performance? Not really but understand that at the time I had no idea (who could have foreseen it) that this stock would go as high as $18.32 from that point alerted ($8.16) only once again to go ALL the way back to ground zero. Point being? The buy signal was clear and the moves to assure profit on the way up may have seemed to some at that time to be overly conservitive? I mean, why not just hold long term? We’ll it’s easy to see it now but when this stock was trading between $16-$18, most seemed to think that it would go up forever (even though it started to consistantly sell off on every bit of good news that came out) This stock I think is just a good example of why you NEED to, on a regularly basis, to “assure profit”

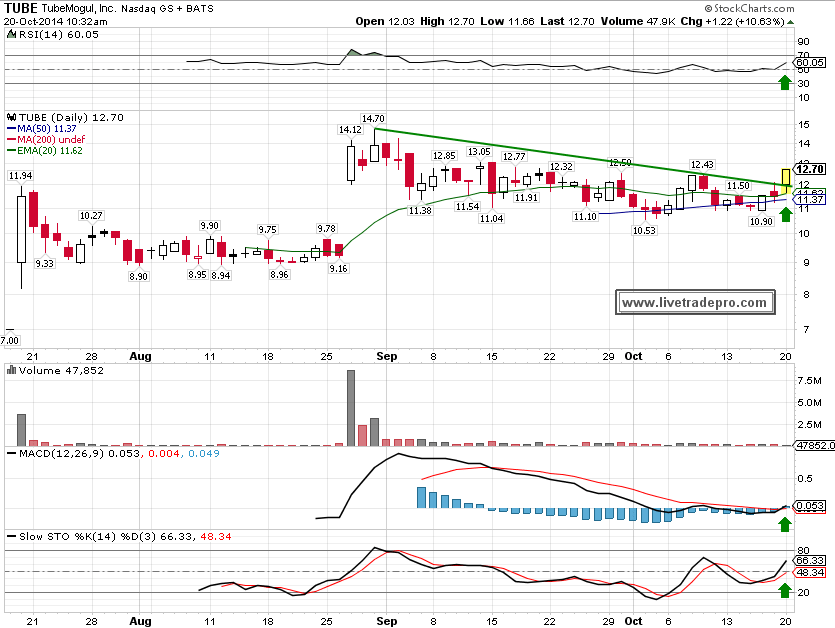

1 Year, (weekly) Chart