November 9th, 2018

Market Expecations

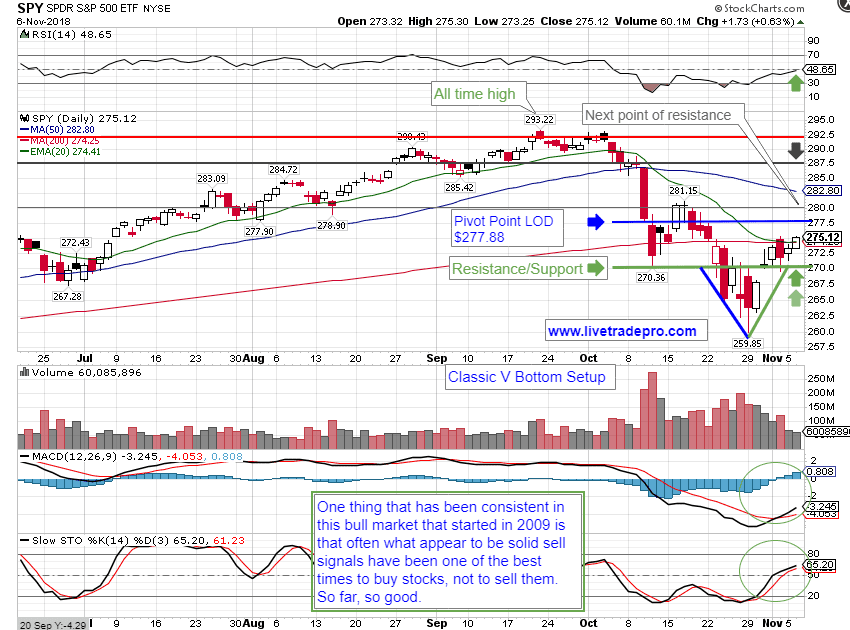

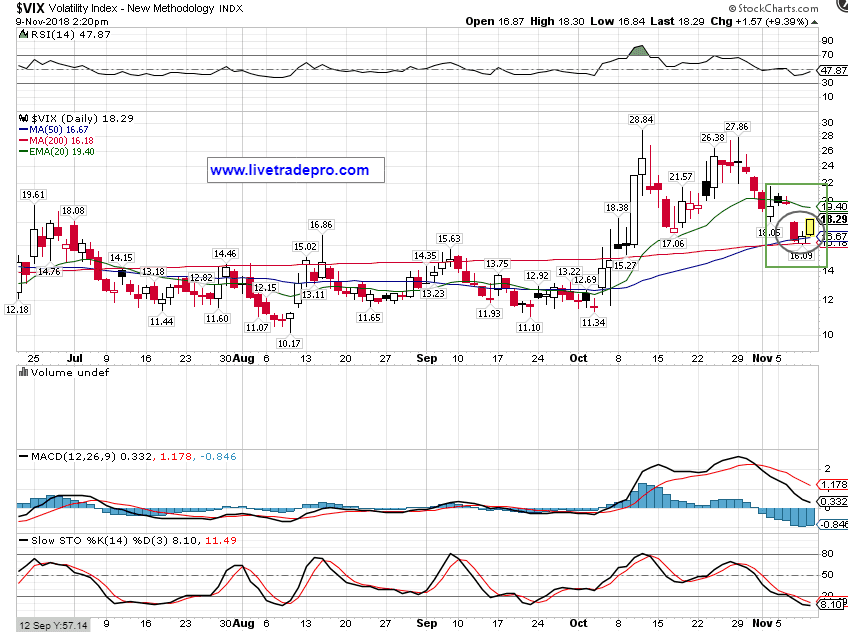

Though the masses are screaming it’s a bear market and that October was the absolute top, there is no real confirmation that we’re in a bear market. Technically we’re in a correction, so that’s how I’m trading it, with good success I might add. If we are at the beginning stages of a bear market, it’s important to understand that it won’t just go down but up and down. This means opportunities on both sides of the trades.

How we traded this week.

The perception to the masses this week was that shorts made money but the truth is it was based on one day (the last day) of the week. The reality for our members was taking long positions and consistently locking in gains along the way, making good profits. We then went short on gold mining stocks with a suggested stop loss of 2% Wednesday that paid big Friday, up 15.2%. We suggested to lock in at least a good portion of those gains. That being said, I’m not ready to call a bottom on gold. We also positioned in UVXY first thing Friday morning as insurance (to hedge) on the overall market. Suggested to take some profits, especially if in large while up 5.1%

Our advantage this week?

I believe the most important thing was that I kept an open mind to what the market might do. While most traders out there were afraid of going long no matter what the evidence and therefore missing substantial opportunities, we started buying stocks low at the first sign of bullish with reasonable downside risk.

Oops

My biggest mistake this week was ROKU Though I’m very happy about the many trades we’ve done on this stock the last few months, I tried too hard to catch it after it got slammed on earnings.The plan was to stop out under $50.00 but instead decided it was a good idea to then add, therefore increasing our risk. Closed that position for a -3.6% loss. Not the end of the world but not a trade that I felt good about.

We’ve done extremely well trading this rally, aggressively buying stocks long beginning October 30th. The truth now however is that we could go in any direction at this point and why I’ll continue to take this one day at a time as always. Understand that even if we do go down there will still most likely be long opportunities. It’s not unusual for some select stocks to buck the trend. Be cautious of those predicting the final outcome. It’s important in times of volatility to stay open minded and to be open and ready for anything, when the evidence compels to do so.

Bottom line.

It was a fantastic, profitable week with many excited members expressing that they did far better than they had ever anticipated! 🙂

Experience my real time alerts and updates now and then watch me walk through each trade, that can help YOU to assure more profit. Join us now with our Free Trial Offer.

Visit my website Updated every trading day! Subscribe to my new Free Newsletter that will also includes some surprise Free stock alerts now. Ask to be put on the list now and be ready to receive my first exclusive newsletter and stock alerts sent to you for Free.