You can reach me at [email protected]

Phone: 802-556-1646

Please also include your phone number and best time to call

Become a better trader FREE 2 WEEK TRIAL

Some of the best reversal set ups will show subtle signals (well under the radar of any stock screener) that can give you good reasons to start buying well before they surge higher, and breakout.

That’s where we come in.

Be sure to see the mini charts to the right to see some of our most recent stock alerts to subscribers.

Join our community now with a FREE 2 week trial

For more active traders, we also alert option trades.

March 9th, 2026

______________________

Stock Recently Alerted

LIVE Trading

Get my alerts FREE for the next 2 weeks now.

To view my latest, most updated annotated charts, click on the links below now..

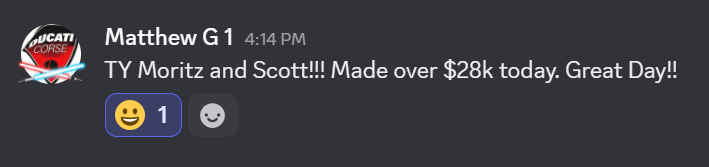

CRDO March 3rd, 2026

Sell off after earnings with the market seems extreme. The push up telling me this likely reverses.

Annotated Chart

Alerted at 94.61

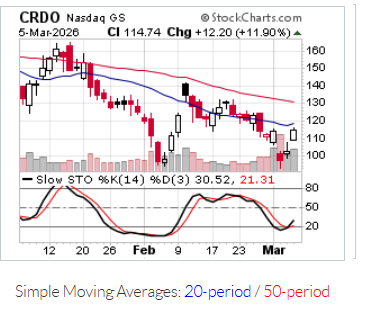

CRWV March 3rd, 2026

Sell off after earnings with the market seems extreme. The push up telling me this likely reverses.

Annotated Chart

Alerted at 71.70

______________________________________

ASTS March 3rd, 2026

This red to green signal after earnings telling me this likely continues higher.

Annotated Chart

Alerted at 86.76

______________________________________

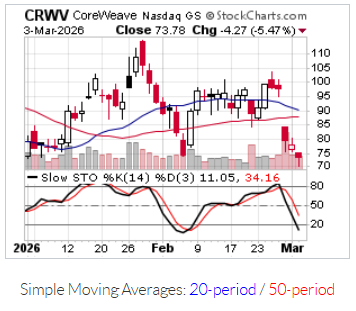

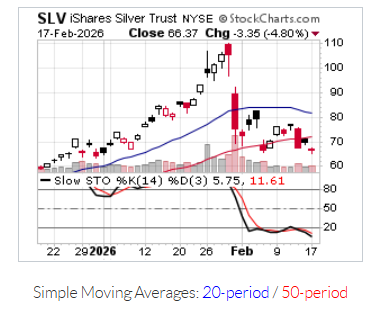

SLV March 3rd, 2026

Selling here has been overdone in my opinion. At support. A higher risk trade but I’m liking the risk to reward factor here. Nice close, back above the market open price of $74.21

Annotated Chart

Alerted at 73.30

______________________________________

CRDO March 3rd, 2026

Double bottom setup. A green close tomorrow would be telling

Annotated Chart

Alerted at 73.30

______________________________________

WDAY March 3rd, 2026

Just saw this one today, and that candle after earnings, along with the follow through today telling me this may just be getting started.

Annotated Chart

Alerted at 139.28

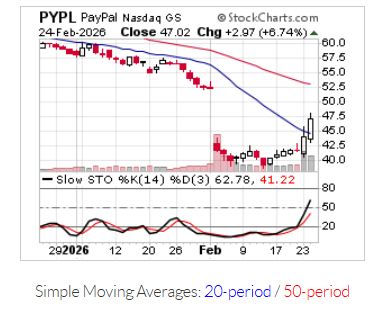

PYPL February 24th, 2026

This move higher on heavy volume after their recent earnings is sending a strong message that this is the bottom.

Annotated Chart

Alerted at 44.24

______________________________________

MSTR February 24th, 2026

Annotated Chart

Alerted at 121.20

______________________________________

GOOGL February 19th, 2026

Annotated Chart

Alerted at 303.22

______________________________________

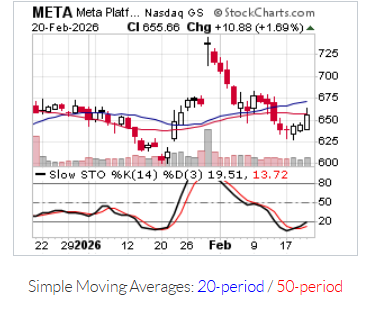

META February 19th, 2026

Annotated Chart

Alerted at 644.17

______________________________________

SLV February 17th, 2026

Annotated Chart

Alerted at 65.87

______________________________________

ISRG February 17th, 2026

Annotated Chart

Alerted at 65.87

______________________________________

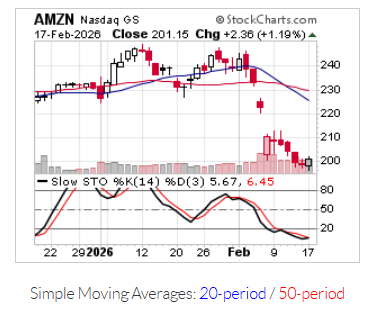

AMZN February 17th, 2026

Annotated Chart

Alerted at 200.68

______________________________________

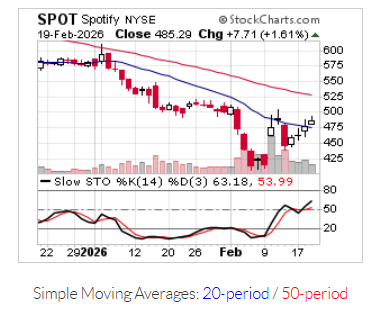

SPOT February 13th, 2026

Annotated Chart

Alerted at 453.50

SPOT RSI went positive Weekly showing a setup for a potential breakout which could signal a change, indicating a longer term trend upwards

Daily chart

______________________________________

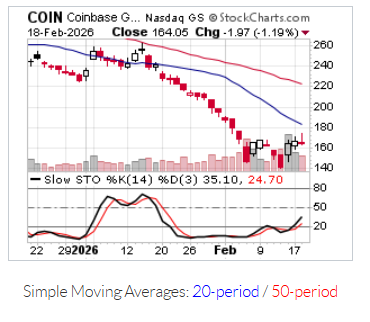

COIN February 12th, 2026 (AH)

Annotated Chart

Alerted at 137.10

TrendSpider

Much more than just good charts!

Experts are saying this is by far the best

AI for trading stocks

Find out more by clicking the link above

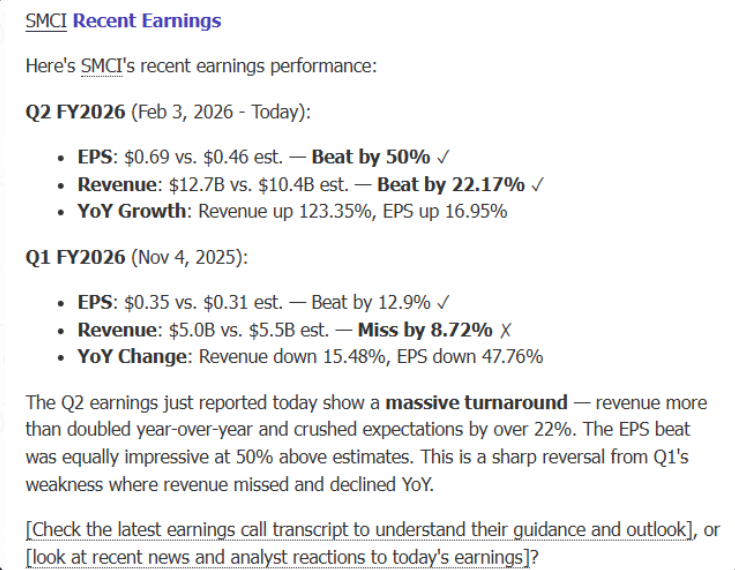

Get earnings reports and so much more IN JUST SECONDS with AI through sources from real data, AND NOT just through the internet that too often prove to be bias.

Here’s an example

All I did was simply type in “SMCI Earnings” and got these results in literally just 5 seconds

Subscribe here now to join our community

Get Your Two Weeks FREE

Your card will not be processed during your trial period

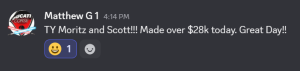

Testimonials

TY Moritz and Scott!!! Made over $28k today. Great Day!!

Matthew G. March 9th, 2026

_________________________

Hi Scott,

I just wanted to reach out and personally thank you for everything you’ve shared through Live Trade Pro. Your insights and discipline have made a profound impact on my trading journey—and my life.

Thanks to your guidance, I’ve reached a point where I can start using my trading gains to travel more and enjoy some well-earned time off. It’s a milestone I couldn’t have imagined before joining the community

While I’ll be cancelling my subscription, it’s only because of the success you helped me achieve. I’m incredibly grateful for the direction you provided when it was needed most, and I’ll always carry the lessons and mindset you instilled.

Wishing you continued success and impact. You’ve built something truly special.

Warm regards,

Chris

_________________________

Thanks for the direction when needed most!

Polis B.

_________________________

_________________________

I appreciate Scott for this very reason—he removes emotions from the market and stays open-minded.

John W.

_________________________

_________________________________

Matthew G.

Matthew G.

Chris G.

Matt G.

David J.

Polis B.

John W.

Matty G.

Moritz

Manuel D.

Khaliq P

Monir A.

David O.

Hardik D.

Tony S.

Nirmam P

Matt J.

Matthew G.

Karl M.

Steve F.

Chez S.

Lou

Adam S.

Francois T.

Kirby N.

Matthew G.

Kerry K.

Matthew G.

Doug N.

Shankar G.

Daniel G

Marc C.

Ganesh S.

Andrew H.

John M.

Q. D.

Samuel D.

Lou N.

Elijah A.

Rob C.

Jake D.

David C.

Josh R

Aurthur S

Arthur S.

Michael C.

Dustin A.

Brad A.

Chandan C.

Phil B.

Israel L.

Vijay C

Ryan L.

James G

Sridhar R.

Derek B.

Ray G.

Khalid A.

Sergey T.

Mark I.

Alison E.

Anil C.

C.T.

Mike B

Nick S.

Hans H.

Daniel W.

Andrew H.

Gustavo A

Chisom A.

Dave G.

Jason H.

Paula R.

Reid H.

Satyam V.

Neetu V.

Crystal L.

Pauline C.

Hasan H.

Andrew M.

ANIL W.

Ryan Y.

Quoc

Pauline C.

Les

Tim S.

Deepa J.

Hamza J.

Wayne L.

Michelle W.

Wayne L.

Farris

Moritz

Chris

Elizabeth

Pablo

Mischa

Dan

Ngoc

Mike

Athena

Ioan S

Johnny

John

Pablo