Start getting some of my best alerts now, for FREE

Email me at [email protected]

In the message area type in “Add me to your mailing list”

This is not your typical newsletter that may give you some ideas during the weekend.

These alerts are sent to you LIVE, the moment that I anticipate a move on that stock.

These are NOT sent once a week, but delivered to your inbox the moment I believe it may signal (along with information on what’s needed to confirm that signal) or has already confirmed telling me that the stock (in my opinion) is likely to continue higher.

________________________________________________________________________________

Some basics of how to better understand and use my alerts

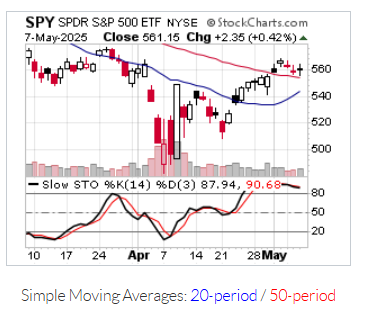

Though these are primarily intended for swing trades they can also be used for positioning in quality stocks that you may want to consider holding longer term. In some cases they could also be used for day trading.

I suggest risking a maximum of -2% -3% on any one trade.

Most stocks that I alert will have at least a 10%-20% upside potential. Those are my expectations. Average holding time could be from a couple of day few days, to a couple weeks. I do not provide specific targets. One reason is that sometimes the upside even surprises me, but I do show key pivot points higher (points of resistance) to help guide you on when to consider taking some profit. I may at times give my view on expectations like “could go to fill this higher gap” and/or “wouldn’t be surprised to see this stock to a new all time high.

I also suggest until you get more familiar with the information that I provide, to start with small positions to further reduce your risk.

Want more? Get 100% of my best alerts every trading day

2 private Discords 1 for regular shares 1 for trading options

Trading assistance with real professionals during market hours

Start getting some of my best alerts now, for FREE

Email me at [email protected]