XBI July 17th, 2023

XBI Biotech Getting some decent reversal action here after retesting the 200 day moving average, and this close now back above the 50 day average. All about follow through now. Note the resistance overhead. Potential breakout above the (downtrading) line.

XBI June 26th, 2023

XBI June 12th, 2023

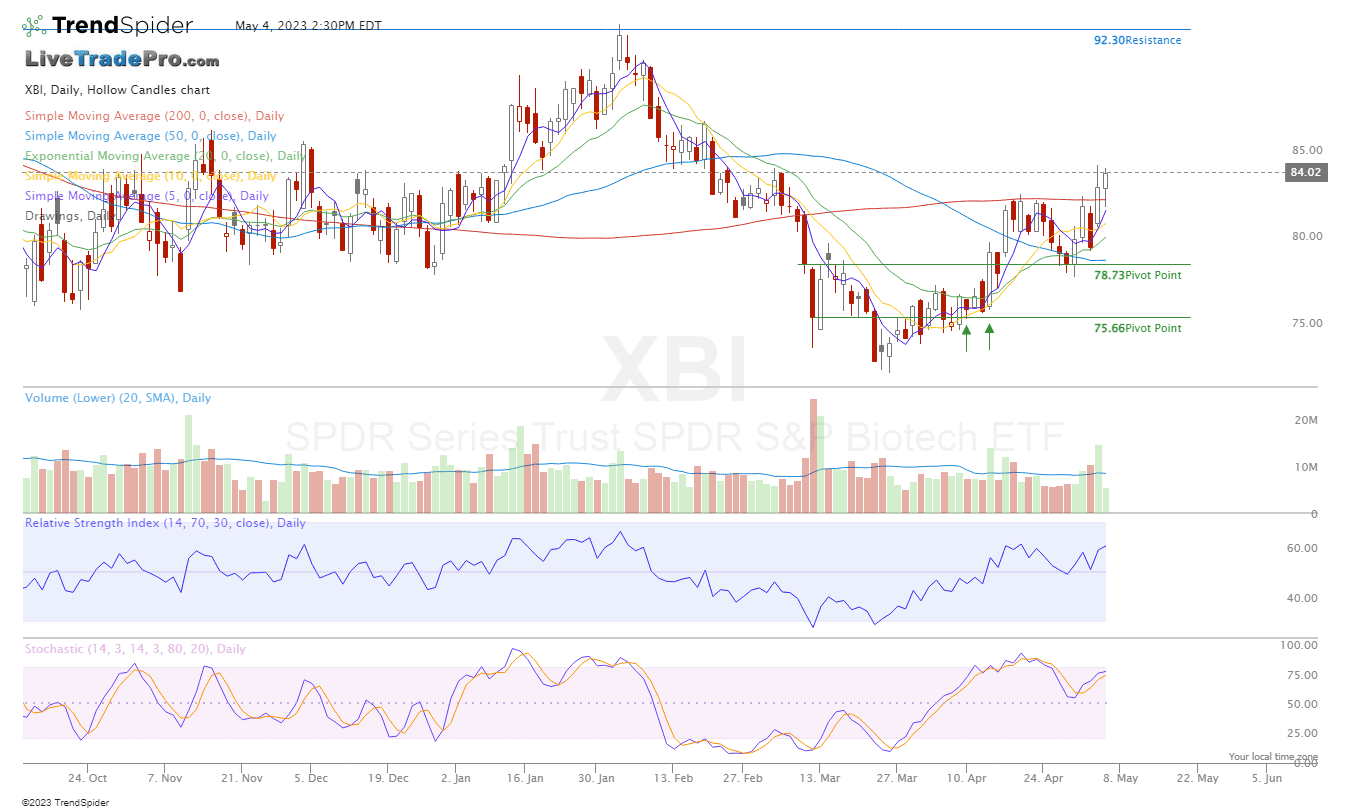

XBI May 4th, 2023

XBI 2nd day pushing back above the 200 day moving average is confirming strength.

Good probability factor.

XBI April 21st, 2023

See my most charts and commentary live in DISCORD chat room Try it for Free here

__________________________________________________________

XBI LABU Longer term this is still trading in a range so based on that and the high volatility (that’s normal) on this ETF, makes it a difficult one to chase. And so would consider locking in some profits into any significant rally. That said, one of the better setup that I’ve seen in some time. 200 day moving average now key.

XBI Biotech April 13th, 2023

XBI A strong (breakout) move today on increased volume e confirming our expectation nicely; closing back above significant resistance, telling me this could now go higher. Worth noting the (up trending) 200 day moving average.

XBI Biotech April 6th, 2023

This bounce attempt, closing back above the 20 day moving average has my attention once again on this Biotech ETF

XBI Feb 23rd, 2023

XBI Jan 24th, 2023

XBI LABU Biotech ETF’s 10:14 PM Now confirming recent expectations. (see more charts below) Getting a solid bounce after retesting key support; the previous point of resistance for this ETF at 85.50. Potential breakout. Continuation higher, likely.