You may also want to see my most recent updates on XBI Biotech – GLD Gold – VIX Volatility

Increase the size and clarity of each chart below by clicking on it.

You may also want to see my most recent updates on XBI Biotech – GLD Gold – VIX Volatility

Increase the size and clarity of each chart below by clicking on it.

QQQ 5 minute chart update (during market hours)

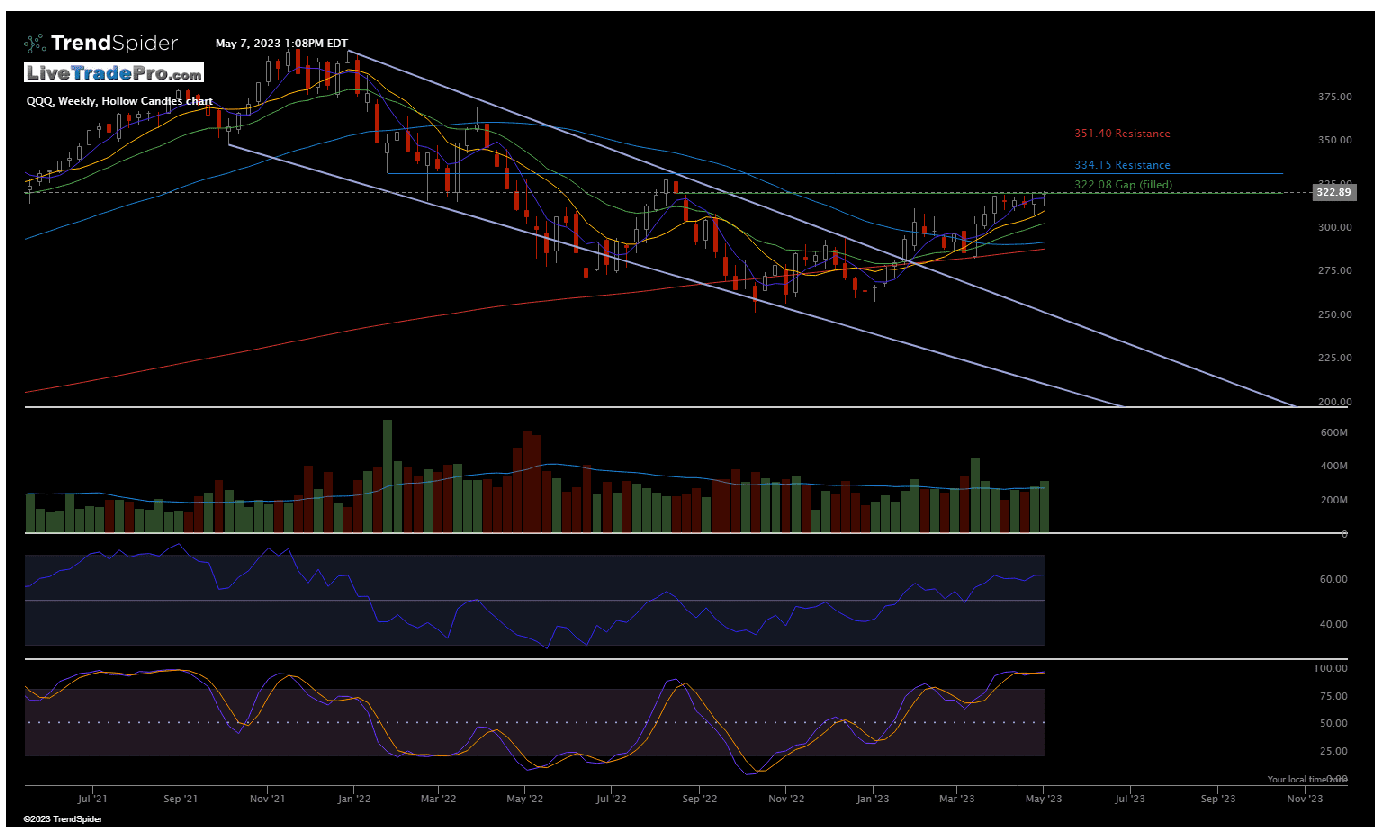

The breakout above this key pivot after filling the lower gap telling me that the stock market has found a direction and most likely is going higher. I also posted this of course for subscribers in chat, and on Twitter and StockTwits.

QQQ This uptrend continues to be questioned by many, even since this initial bullish signal that happened on January 23rd. Since then the index has held well above the 50 day moving average and for the most part, consistently above the 20 day moving average.

Solid week here with a higher high, higher low. I’m thinking continuation higher, likely. I continue to see an uptrend in this market unless proven otherwise. Expecting higher.

XLF Bank stocks confirmed strength today; closing above this key pivot point (initial point of resistance). Also note the MACD turned positive today. Follow through now key. See what tomorrow brings.

QQQ Chart updated during market hours. Though the bank stocks continue to sell off and other major indexes today havn ‘t been able to hold their gains, QQQ looks strong; pushing back above both the 50 and 200 day moving average. Also note here the 50 day average is now arched upward, above the 200 day moving average. Not a small thing.

QQQ Update March 29th Nice continuation. Most recent “Bull Flag” setup confirming strength. Continuation higher likely.

QQQ A strong move, well above the 200 day moving average after this failed breakdown Continuation higher, likely.

QQQ Hammer candlestick. Retest of the 200 day moving average. Ideally want to see this stay above. All about follow through now.

QQQ Weekly chart update. It’s only Tuesday but this action is already starting to nicely confirm the expectation to go higher. See charts below. Wouldn’t be surprised to now see it test this higher gap, and perhaps then some.