You may also want to see my most recent updates on XBI Biotech – GLD Gold – VIX Volatility

Increase the size and clarity of each chart below by clicking on it.

You may also want to see my most recent updates on XBI Biotech – GLD Gold – VIX Volatility

Increase the size and clarity of each chart below by clicking on it.

IWM Small caps. Reversal setup with good initial confirmation. This close back above the 50 day moving average is attention getting. And given the overall action on the major indexes, along with select individual stocks, believe this is likely to now continue higher. See what we get.

SPY Gap filled, with continuation. 50 day moving average key. Bullish follow through could push this higher to potentially fill this higher gap and/or test the 200 day moving average. Will likely take time and/or volume to stay above if that occurs.

Caution There are still bearish overtones and so sometimes what appears to be a buy signal and/or breakout above a key moving average can quickly turn into sell signals. I continue to trade with smaller positions at this time.

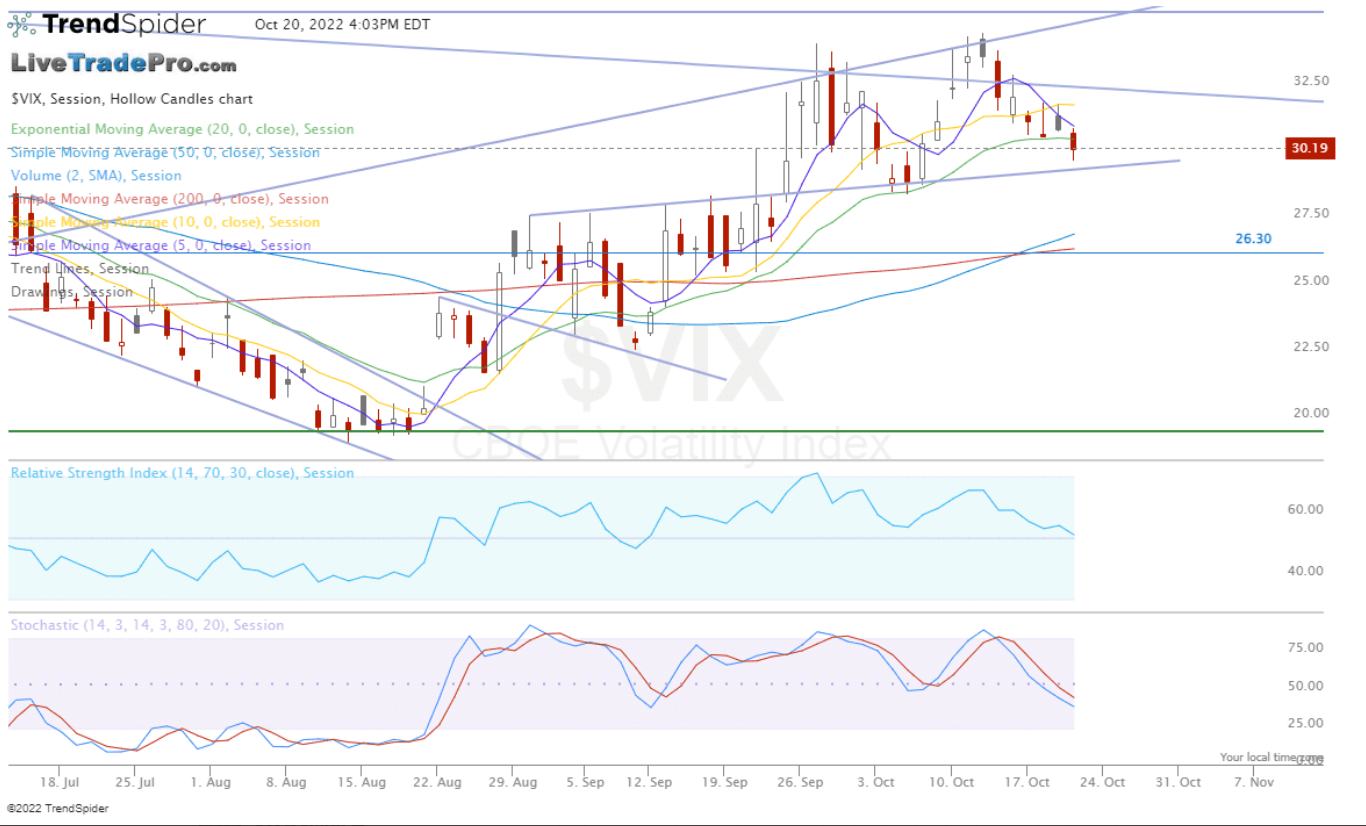

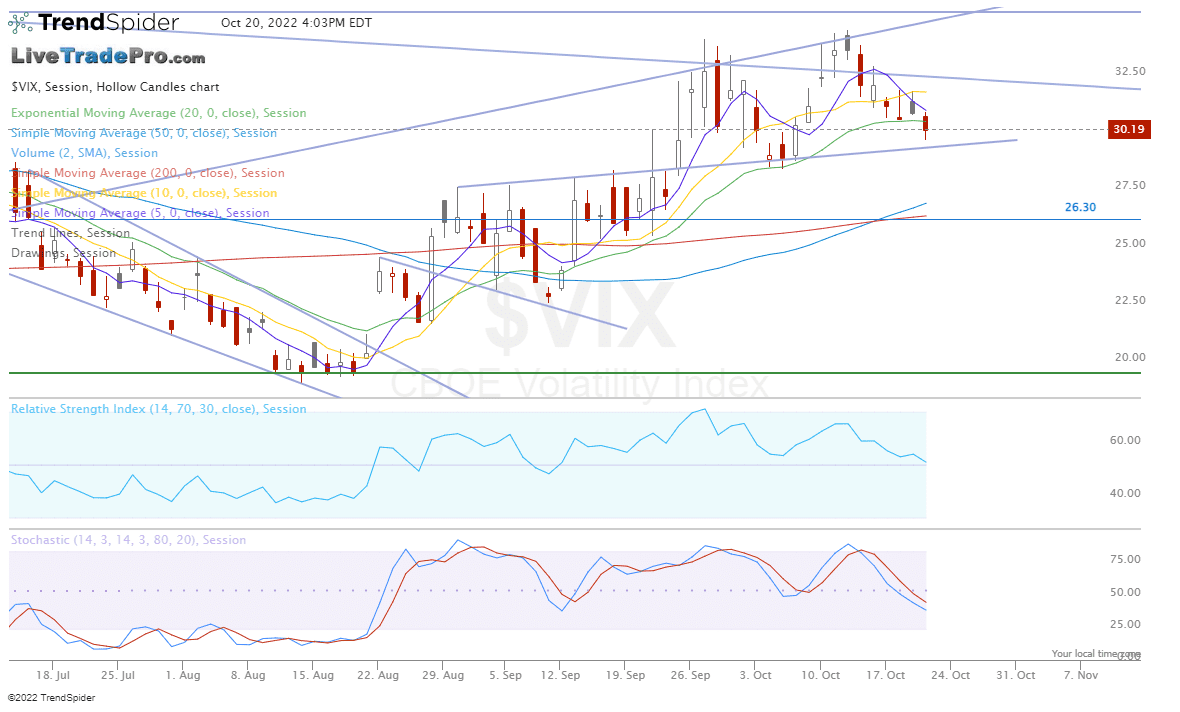

VIX This consistent rejection at lower points of resistance, since filling the gap above on December 22nd is telling me that bulls are starting to gain some traction going into this new year.

BOTTOM? I’m thinking this could be an indication of a reversal in the trend for the stock market.

VIX There continue to many skeptics about this market but I think what some may have missed today (and why I’m posting this here) with the major indexes closing red, is that the VIX also closed red. More importantly it closed under the 20 day average. That’s the 1st time it’s done so since September 9th, 2022 I see this as bullish for the market, based on probability.

What some may have missed (because of all the volatility on this day with all three major indexes closing red) is that this closed red. More importantly it closed under the 20 day moving average. That’s the 1st time it’s done so since September 9th, 2022 I see this as bullish for the market (based on probability)

Posted during market hours after the pullback. What I’m seeing now. Market open at 269.93 If this holds, market could go higher.